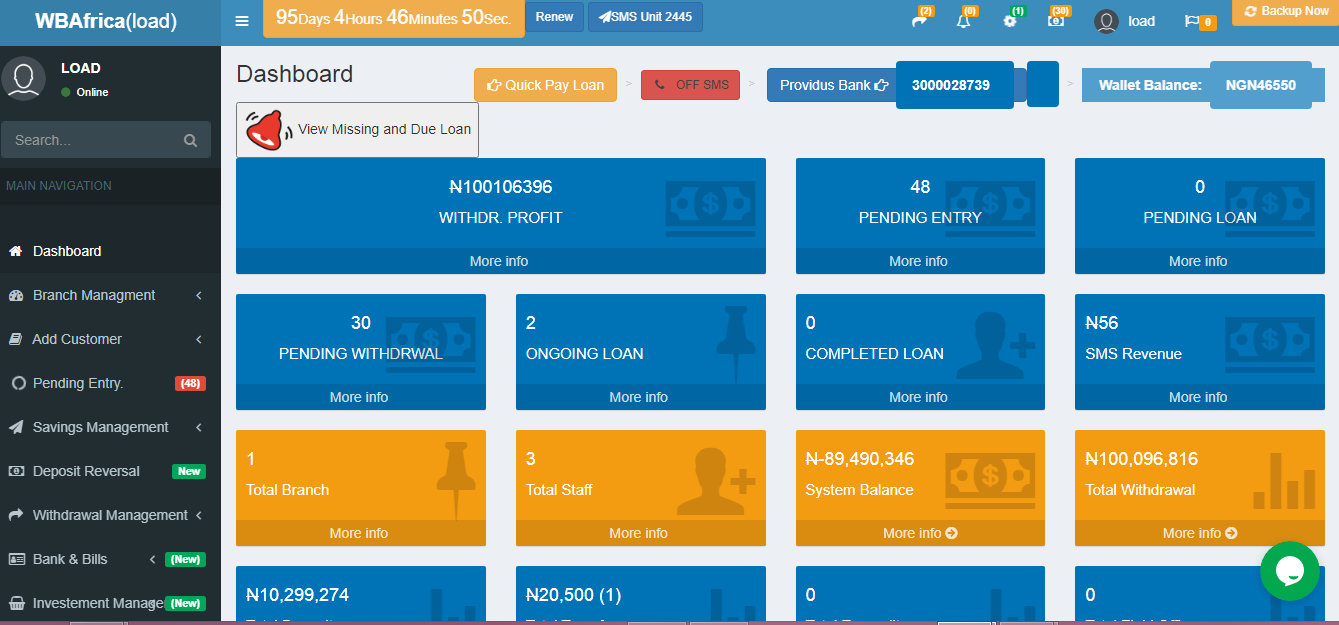

Wired Banking Africa is a solution that automates cooperative, MFI, Sacco and Financial NGO processes like Savings management, Loans management, E-Banking, accounting and reporting it is also an efficient way to manage your coopertive operation in one safe place..

![]() Please Wait...

Please Wait...