![]() Please Wait...

Please Wait...

![]() Please Wait...

Please Wait...

WHO WE ARE

Wired Banking Africa W is a registered trademark of Wobilo Africa Limited with RC No: 1732793 a duly registered legal entity in Nigeria, with the Nigerian Corporate Affairs Commission. All Virtual Payment services are powered by Our Partner Bank; Providus Bank licensed by the Central Bank of Nigeria. WBAfrica financial services is provided under a Cooperative License regulatory provision with registration number *RC:34343*..

We pride ourselves in providing the very best personalized solutions for our customers to achieve their goals

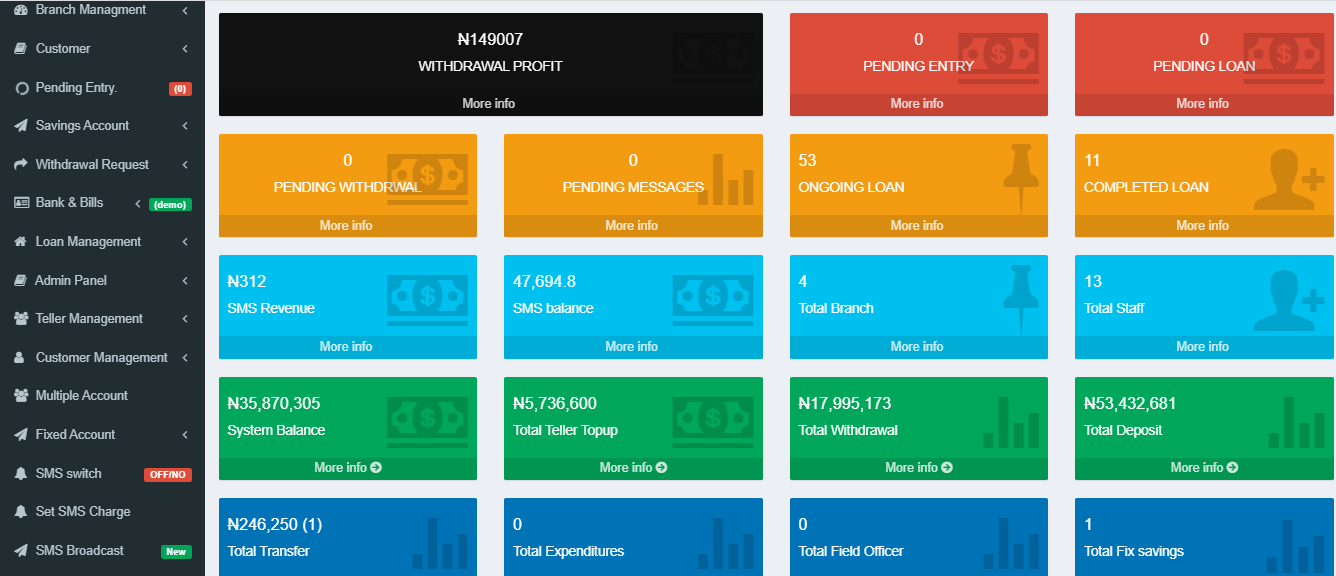

WIRED BANKING AFRICA is a core banking system deployed for financial institutions (MFI, Cooperative society etc); to enhance Thrift Collection, Daily Savings, Esusu/Akaw/ Ajo/Adashe Contribution, Loan, Investment and Asset Management across Africa....

OUR MISSION

As most Financial Cooperative/Institution in Africa maintain the records of their cooperative members (Credit/Debit) in a notebook and also provide a booklet for each member for transparent transaction, just as the banks were doing in those days.

However, today banking system has shifted from manual book keeping records to the use of Information Technology to enhance their efficiency in performing their accounting.

Wired Banking Management System This is a System specifically deploy for Financial institution to carryout Microcredit, saving management, Loan and Asset management also have access to digital banking solution in one simple and secure platform- give - Access to end customer and it excos.

OUR SOLUTION: THE PROPOSED METHOD OF COLLECTING ESUSU USING MOBILE DEVICE

Cash Payment System (CPS): This involves the Institution collecting cash from each of the customers at their business points in their respective shops. The Institution after each collection credit the customer via WBA portal while it send SMS to the office. The information passes through a gateway and hits the collector’s till box. A till box is an account the collector keeps with the backend office (WBAMS). The information is stored and an alert of the amount received from the customer is sent back to the customer. The customer receives the message through SMS on his mobile device. The alert takes place in microsecond such that the collector would still be in the customer’s office while the customer receives the alert if network is stable.

A diagrammatic representation of such a system is shown below:

Flow of Payment and services

Withdrawal of Money: CPS involves the use of Automated Teller Machine (ATM) to withdraw money unlike the current practice of a collector bringing cash to the customer on request. The use of ATM is ideal since the Institution office is registered with WBA that provides commercial services. The ATMs are mounted at strategic places in markets where customers will have access to withdraw money at any time.

The Advantages of Such a System Include:

The money is readily available unlike the current system where the collector could be delayed in coming with money due to issues like sickness. The collector could be attacked on the road.

The ATMs are mounted in various locations. Therefore when an ATM is not functional, another ATM would be available to satisfy customer needs.

Interbank Transfer: This involves the use of Mobile Devices, but instead of cash payments or withdrawals, it involves the use of mobile money transfers. The system involves each customer and if the customer chooses to use mobile money transfer approach, the transfer is made. Once the transfer is made, it notification web-hook and deduct from the customer balance, the back office which Now sends a debit alert back to the customer.

Receiving money/ Funding of Wallet via Virtual Account: The same method is applied in Deposit. The customer can transfer to his account via his wallet account or virtual account that will be generated for him while registering,

Bill payment: We also allow the end customers, to pay their bills or purchase airtime via their wallet.

OUR CURRENT CHANNELS OF OPERATIONS

Additional Banking Tools

Coming Soon Project:(Launching 28/07/20) Wired Money is a friendly automated WhatsApp chatbot programmed to automate every individual whatsapp account; This is to enable our subscriber transact via social media (WhatsApp & FacebooK) Features: (Send & Receive fund) Inter-Bank transfer within Nigeria, Buy Airtime/Data, Pay cable TV & Electricity, Do Wallet transfer, etc)

REGISTER YOUR INSTITUTION BUSINESS LOGIN